Customer and market research is fundamental in helping product marketers gain an invaluable understanding of the sphere in which they’re operating, the people they’re targeting, whilst also gaining essential feedback to improve their product or service.

This phase is critical in gauging an understanding of:

- What you need to provide for your customer,

- How well a product or service has performed, and

- Where changes can be made in the future.

But where do you get such insights? How do you get customer and prospects to speak to you? What do you ask them when you do chat to them? How do you consolidate all that information? What actions do you need to put in place.

Lots of questions. All the answers. 👇

In this guide, we'll be unpacking:

- Customer & market research essentials

- Why communication is important

- When customer and market research is needed

- Alternative access to buyer insights

- Getting started with research

What's inside this guide?

Everything you need to truly embody the voice of the customer, that's what. Tap into the tried and tested research methodologies of product marketers at some of the world's biggest brands, and take your research game to a whole new level.

Part 1: presentations

- Crush CX with human-centered design

- Building products with the customer in mind

- 8 tips for effective win-loss analysis

- Top 5 reasons your win-loss programs fail

- How to set up a win-loss program that drives actionable insights

Part 2: templates

- Win-loss email invite templates

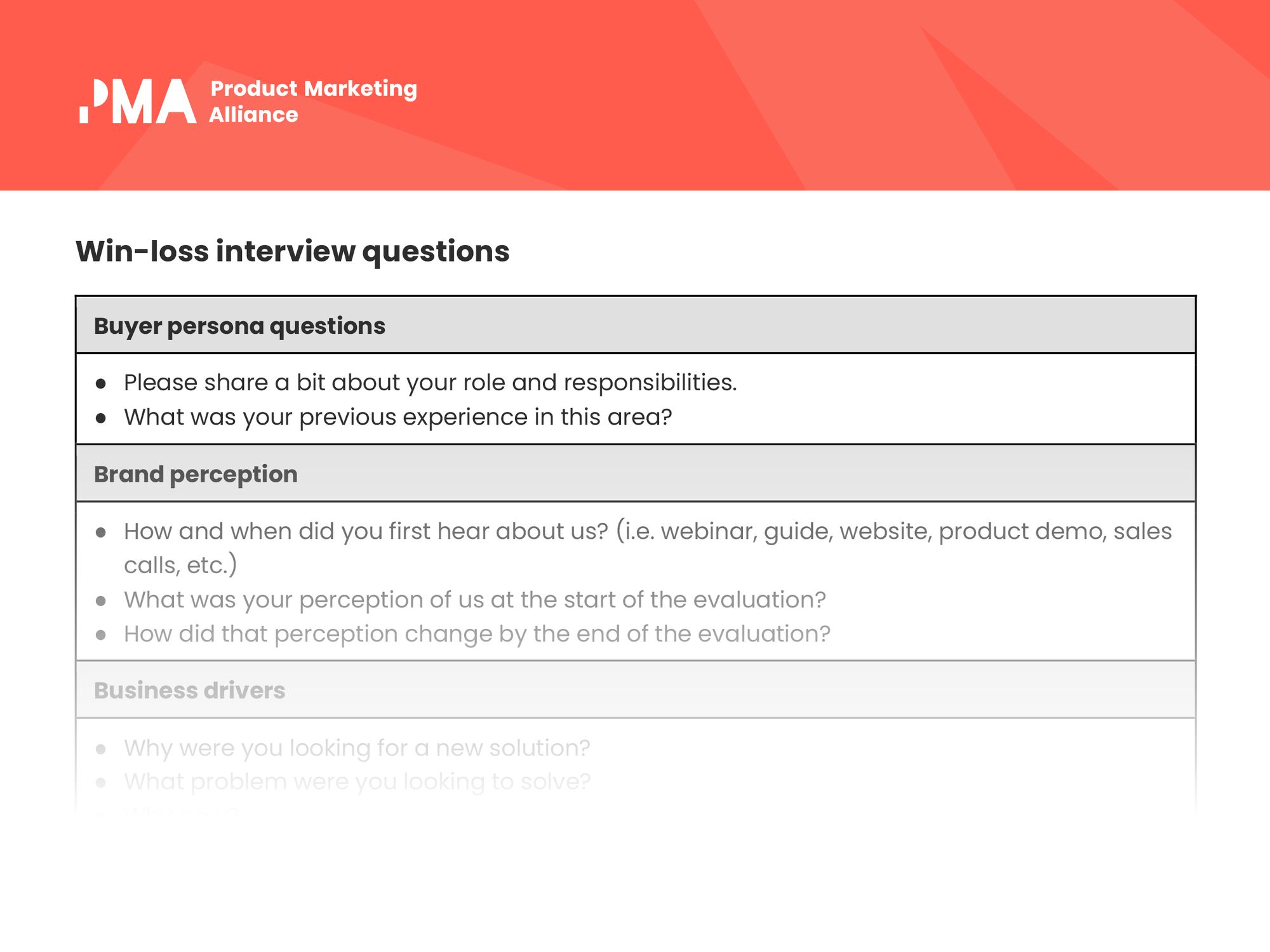

- Win-loss interview questions

- Customer feedback master list

Part 3: research guides

- Building a data-driven win-loss program

- Steps to sharpen your go-to-market focus with customer segmentation

- Change tack and move from features to what customers really care about

- How to incorporate the voice of the customer into your product marketing strategy

- Being customer-obsessed at a product first organization

- Customer needs and how to meet them

- Qualitative vs quantitative research

- How to become a product marketing scientist

There's plenty more where this came from. 👆

Unlock it all in here. 👇

Customer & market research unpacked

Trying to bring a product to life with no understanding of your customers and market is like boarding a plane with no wings - you won’t get anywhere, anytime soon.

Customer and market research is fundamental in helping product marketers gain an invaluable understanding of the sphere in which they’re operating, and the people they’re targeting, whilst also gaining essential feedback to improve their product or service.

What is market and customer research?

While Beyonce lives and breathes music and David Beckham lives and breathes sport, product marketers must embrace customer and market research.

A fundamental part of product marketing, customer and market research serves as the perfect opportunity for PMMs to see the world from the perspective of the consumer; responses are critical in gauging an understanding of:

- What you need to provide for your customer,

- How well a product or service has performed, and

- Where changes can be made in the future.

There can be a degree of confusion surrounding the topic and it’s common for some to cross their wires, slightly, and confuse market research with win/loss interviews.

You may fall into the same boat. If so, don’t sweat it. You’re not on your own, and we’re here to help.

Customer and market research allows companies to refine their product pre-launch, by addressing the pain points of their prospective customers and also confronting any flaws in the product that may need to be ironed out, after it’s gone to market.

Things worth having don’t land in your lap; you’ve got to work for it. Product marketers need to plan meticulously, and customer and market research is very much a part of the recipe for success, as we’ve highlighted in our essential checklist:

Check out our guide explaining the core essentials of the area, offering an explanation surrounding the what, why, and how. 👇

Differences between market research and customer research

Market research refers to understanding the competitive environment and overall market that your company operates within. This allows you to position your product more accurately in the market.

Customer research is all about understanding your customers' needs and behaviors in order to appeal to them and create messaging that is relevant to them, in order to sell your product in a meaningful way.

Why is communication important?

Product marketers need to communicate with their customers. Period.

Don’t just take our word for it; 77% of people we surveyed in the State of Product Marketing Report 2021 identified strong communication as the leading skill PMMs need to succeed.

Which brings us to our next question: when was the last time you spoke to your customer?

After all, they’re the people who use your product, sing its praises, but most importantly, let people know when you’re not ticking the boxes.

Word of mouth spreads like wildfire, so you need to pick up the phone, schedule a Zoom call, and make sure your understanding of your customers is tip-top.

There are a whole bunch of key questions you should be asking yourself:

- Why market to current customers?

- How can qualitative interviews be used to gain essential information?

- Why does the customer trust you, buy from you, and recommend your product?

- Plus, who are your customers, and have they changed over time?

Are these questions enough to set your pulse racing? If so, relax.

Here are a couple of pieces on customer communication we cooked up earlier - enjoy.

When is customer and market research needed?

Put simply, communication needs to be at the heart of a product marketers’ practice; a silent PMM will orchestrate their downfall.

The more a product marketer speaks with their customers, the more feedback they’ll get, and the more they’ll be able to refine their practice. On the other hand, if you don’t reach out to the people who matter the most, i.e. your customer, you’ll be stabbing in the dark and relying on your assumptions.

No number’s been set aside from the PMM gods as far as frequency is concerned, but as we’d alluded to previously, the more you speak, the more you’ll gain. 🤷♂️

We spoke with a range of product marketers, each giving their insight into how often they tend to reach out to their target audience. 👇

Why is market research important?

Do Hershey’s launch a new candy bar without taste tests? Do ad campaigns get signed off without test screenings? Or do fast-food chains launch new burgers without checking out what the punters’ tastebuds are craving?

Answer: A resounding no. Rather than acting on a whim, the company completes meticulous market research beforehand, to improve their chances of a hit, and reduce the likelihood of an expensive pink elephant.

In a nutshell, market research spills the beans on what prompts customers to put their hand in their pocket, buy products and services, and part with their cash.

The process is critical to ensure that the best decisions are made by a company. But how does it help, and why should every company sit up and take notice? All shall be revealed...

The benefits of conducting market research

It helps you identify your customer base

It’s impossible to build a successful product unless you communicate with prospective customers. Market research provides a set of definitive answers to key questions, including:

- Who is your product aimed at?

- Who are your customer personas?

- What features do they want from your product?

- How much are they willing to spend?

The market research process allows you to clearly paint an image of:

a) your ideal customer - gender, age, location, income, etc.

b) the product you’re going to create, as dictated by the needs of the customer.

When you’ve identified who and what you’re creating, you’re able to successfully tailor your marketing strategy and pricing plans, accordingly.

It can prevent sloppy mistakes

Before launching a product, it’s important to conduct rigorous research and testing, to avoid silly (and expensive) errors.

Let prospective buyers test it out beforehand, so you can iron out any imperfections by conducting market research.

While your hunch may tell you your product will resonate with consumers, it’s not recommended to make a decision based on gut instinct; if things go wrong, you’ll be left rueing your choice not to conduct simple testing.

Focus groups are a great source of customer and market feedback. If things go swimmingly, you’ve got the peace of mind you need and you can push on with the launch. If there are areas for improvement, just go back to the drawing board and make your service even better.

You can protect your business

Market research not only indicates what the market is like now, it allows you to forecast how your industry could shape up in the future.

Proactivity helps you exploit potential gaps in the market other companies may not have spotted, so always stay on your toes and keep your eyes peeled for market opportunities.

Take HMV, for example. While they continued to channel their efforts into the sales of CDs and DVDs, Spotify and Netflix researched the market and developed mobile platforms offering music and film on demand, in line with emerging trends. In 2019, Netflix’s assets were $34.9bn, Spotify was being heralded as ‘the savior of the music industry’, while HMV called in administrators for the second time in 6-years.

Winner: Market research, by knockout.

Surpass rivals with competitive intelligence

Competitive intelligence can help you and your product marketing team understand the methods being used by your competitors, how their products work, key features and USPs, and pricing strategies, to name a few.

Business is cut-throat, and when a rival poaches customers, it’s often because they’re better prepared and have completed more in-depth research.

Preparation is key for any company, and this remains the same as far as market research is concerned. Don’t get caught in the shadow of your rivals - make them chase you. Seek valuable insights and use your findings to create an innovative strategy that’ll not only generate new leads but also improve customer retention and reduce customer churn.

How to share competitive intelligence findings

To make the most of competitive intelligence, you need to communicate your findings so your teams can use the information to develop and evolve your product.

Results are useless if you keep them to yourself - you need to share the knowledge. Our Competitive Intelligence Trends Report 2020 revealed 87% of product marketers share their findings with Sales teams, closely followed by Product (83%).

Previously, it’s been suggested there’s room for improvement in relations between product marketers and leadership teams. However, it was encouraging to see a significant proportion of people taking part (77%) saying they discuss their findings with executives and leaders.

When we dug a little deeper and explored the preferred methods for sharing competitor intel findings, we found knowledge was shared in-person on a team-by-team basis, and by segmented emails to each relevant team.

Both of these areas accounted for 34% of responses, while a further quarter indicated they send blanket emails to relevant teams within the organization.

Of the 25% of people who fell into the ‘Other’ category, the likes of battle cards, Slack channels, and tools such as Klue were identified as the chosen method of communication. With so many different ways of sharing information, we spoke with Matt Powell, Product Marketing Manager at Docebo, to get an insight into how competitor intel findings are shared at his company:

“I don’t think there is a silver bullet for effectively sharing competitive intel - it’s completely dependent on the realities of your business. I do, however, think that it’s all about creating a culture internally in which everyone is as actively involved in gathering and sharing competitive intel as possible.

“That’s a big behavioral change when it becomes less about having one or a few people gathering and sharing intel, and instead extending it as a responsibility of everyone in the revenue organization. That’s when good things start to happen - the activity becomes more collaborative and is focused on problem-solving rather than just information sharing.

“We share our intel on a team-to-team basis leveraging our competitive intelligence platform to develop regularly cadenced newsletters. They’re good and they’re actionable, but we find the juicy stuff is the intel that happens in real-time. But, I’ve found the most effective way to share intel and have great conversations in the flow of work around competitive intel is through Slack.

“Our company is a big-time Slack shop - everything happens there. However, there was a lot of good intel being lost in the scroll of conversations. To combat that, we turned it into an opportunity by installing a two-way integration that allows us to send competitive intel to our CI platform directly from Slack.

“This has been a bit of a game-changer in making sure that as much information as possible isn’t lost. The great thing about these kinds of Slack channels is that the intel is only the tipping point, the conversations that happen in the threads afterward generally end up being the context you need to make the intel actionable.”

How does behavioral research improve consumer experience?

Your customers won’t always tell you what they think - or know what they will do next. Using behavioral research can help you to avoid this bias in qualitative consumer research. This isn’t to say that qualitative research has no value. But by mapping and analyzing what your customers are actually doing (instead of what they say they’re going to do) you can better understand behavior patterns.

This can help you to appeal to your customers by allowing you to send the right marketing messages at the right time, to make the biggest difference in your customer's behavior.

Primary vs secondary research

There are two forms of data PMMs can collect when researching: primary and secondary.

Primary data

Primary information is collected yourself or by a specialist who has been hired to collect the data on your behalf.

For example, the PMA team collected primary data for our State of Product Marketing report, while we’re asking questions to the 1000s of product marketers who are members of our Slack community, daily.

Primary research is based on two types of information: exploratory or specific.

Exploratory research is open-ended, with respondents usually providing their views in an unstructured interview scenario.

On the other hand, specific research tends to be more structured, to solve a particular problem highlighted during the exploratory phase.

When arranging primary research, it’s important to identify the preferred method of communication, whether this is direct mail, phone, or interviews.

These should be considered carefully, given the response rate for each method varies. For example, people tend to prefer a quick chat on the phone, rather than taking more time to respond via direct mail.

Social media is also a widely used tool for conducting market research. Features such as Instagram stories allow companies to gather opinions from 1,000s of followers in a short space of time.

Secondary data

Secondary data has been completed for you and is organized for reference. This data includes things like:

- Reports

- Books

- Journals

- Newspapers

- Letters

- Government websites.

Information for secondary data is often available to the public and can be found in libraries, educational institutions, etc.

Media outlets such as newspaper publishers and TV stations host a breadth of information that can be used when gathering secondary data. This includes demographic information outlining income, age, gender, etc.

What is quantitative data?

Quantitative research includes cold, hard facts that can be easily converted into graphs and charts. The research is usually carried out using surveys and questionnaires with closed-ended questions, yes or no questions, checkbox or multiple-choice questions, and questions with intervals or ratios. It’s structured, statistical, and number-based.

What are the benefits of quantitative data?

Quantitative data is useful for conclusive answers, it’s easy to analyze and can help prove or disprove hypotheses. The questions are also quicker and easier to answer, so you’re likely to get more responses.

What is qualitative data?

Qualitative data is non-statistical and consists of impressions, opinions, and views. It’s generally used to answer ‘why’ questions. It’s investigative in nature and asks open-ended questions. Qualitative data can be generated through:

- Texts and documents

- Audio and video recordings

- Images and symbols

- Interview transcripts and focus groups

- Observations and notes

What are the benefits of qualitative data?

Qualitative research gives you a deeper insight into the motivations behind the statistics. It’s used to theorize and interpret, and instead of asking how many people buy your product, it asks why they buy or why they’re not buying it.

Which data is better for research?

Whether or not you decide to use qualitative or quantitative data will depend on the results you’re looking for.

If, for example, your product was an app that maps bike routes, using qualitative questions like “What do you think of our app?” will lead to many, many different answers, they might focus on speed, responsiveness, and price, which could actually be really invaluable information for you to look at.

However, if you want a specific question answering, like: “How responsive is this app?”

- Super responsive

- Sometimes responsive

- Not at all

Then, quantitative data is your best bet.

Types of primary research

There are a few different ways to conduct primary research - this section will discuss a few.

1. Surveys

Surveys are where you ask your customers a series of questions. These can help you to gain lots of quantitative data and answer specific questions. You can also gather some qualitative data through a survey but this isn’t normally very detailed.

2. Interviews

Interviews allow you to talk to your customers while you ask them questions. This can allow you to gain more insights and qualitative data, as you can ask follow up questions if an answer is particularly interesting.

3. Focus groups

Focus groups can let you ask specific questions about your products by letting customers use your product, feedback, and discuss with each other. This may allow more accurate feedback on your product since it is being used during the session.

4. Customer observations

Customer observations involve watching or tracking customers’ behavior while using your product. This will help you to understand how your product is actually being used and can show areas where users make mistakes or get stuck.

How to identify the right people to engage in market and customer research

How to choose your sample

It’s essential to gain the opinions of those who matter, i.e. people with your buyer personas. To form a perfect sample, there are some guidelines we recommend you don’t flout:

- Aim for 10 participants per buyer persona: There may be some instances when you decide to focus on multiple personas, in which case, source separate sample groups for each, and be sure to include roughly 10 people in each.

- Search recent surveys: If you’ve completed a recent survey, tap into your existing resources. If the sample has had recent exposure to your company, their recollections will be more reliable.

Mix it up: While a sample formed wholly of your loyal fanbase may massage your ego, it’ll compromise the quality of your market research. So, mix it up a little, and seek a variety of opinions. Include people who’ve purchased your product, fans of your competitor, or people who may be on the fence. Throw yourself out of your comfort zone, put on your hard hat, and prepare for a mixed response; criticism is your friend, not your enemy.

How to engage your audience

Market research firms have a catalogue of participants readily available at their fingertips, but not every company has the same luxury, meaning we need to get our hands dirty and find people ourselves.

It may seem a pain in the ass, but in reality, there are several ways to recruit respondents for your group.

- Incentives. It’s often the case people want to be compensated for their time, and a small incentive will, more often than not, give them the impetus to agree to research. Whether it’s a small payment, or a shopping voucher, it’s a small price to pay to get your research over the line. If you can’t afford to offer incentives, give them access to members content on your website, or loyalty points towards future purchases.

- Be social. Twitter, Facebook, Instagram and LinkedIn all share one trait: they house your fans (or followers) in one place, meaning you can send a blanket rallying call asking for support and take your pick. Piece of cake.

- Use your CRM. Your CRM system should be your best friend when it comes to picking a sample, as it saves precious time. With the click of a button, you can immediately apply a filter to applicable time periods, genders, ages, etc. and contact the relevant people for your study. Also, be sure to liaise with sales teams who will be able to help, if you need support accessing accounts.

- Spread the word. Whether it’s your family members, friends, colleagues, tell everyone you can possibly think of you’re conducting a study and need help. Share posts on LinkedIn and ask others to like and share, and before you know it, your initial post will reach 1,000s of prospective respondents. The more creative you are, the more people you’ll attract.

Alternative access to buyer insights

We’ve said it before, and we’ll say it again: when you aren’t clued up about your buyer, we can virtually guarantee the campaign you’ve worked endlessly to bring to life will die a slow and painful death.

Which (surprise, surprise), customer and market research is worth its weight in gold; when you execute it properly, you’ll know your buyer like the back of your hand.

However, there are other means you can explore, not necessarily to replace customer and market research but to supplement your efforts and make the result even stronger.

For instance, you can unearth a breadth of information by talking with your sales department, who’ll be able to provide you with a berth of insights relating to prospects and customers, such as needs and wants, budget holders, etc.

Similarly, conversations with prospects and existing customers at trade shows are useful, while a host of information can be found via digital data, as well as customer support days within your company.

Remember: Don’t be blinkered by the common assumption customer and market research is limited to picking up a phone and having a conversation. Sure, this is essential, but if you cast the net even further, your bounty will be much greater.

How to conduct research moving forward

To learn, develop, and improve, we’ve got to take the rough with the smooth - it ain’t plain-sailing all the time.

Win-loss interviews make the most of the good, the bad, and in some instances, the ugly, putting you face-to-face with leads who’ve converted and become customers, as well as the ones who for whatever reason slipped through the net.

Sure, the process can be painful, and while it’s great listening to people wax lyrical about what you did well, it’s what you didn’t do so great sticks in the memory and can drive you forward in the future.

Win/loss interviews hold a whole string of benefits, as far as customer/market research is concerned. Not only do you learn more about your customers, but because you’re speaking with leads who’ve gone elsewhere, you can discover where you fell short, and what competitors are offering that you aren’t.

It’s human nature to like winning; nobody likes losing, particularly in a business sense. Use win-loss interviews to identify your strengths and weaknesses, assess where you can improve, before implementing a revised strategy.

We’ve dug through our PMA back-catalog to present you with all you need to know about the essentials of win-loss interviews, courtesy of the trio of treats below:

Customer and market research: an alternative viewpoint

There’s no doubting customer and market research’s contribution to the overarching strategy within product marketing teams, with top companies across multiple industries devoting their time to perfecting their efforts.

Bree Bunzel, APAC Product Marketing Lead at Dropbox, gave her insights into customer listening and what CABs look like over at Dropbox. She outlined the key figures of who's involved, how often they run them, their agendas, and how they share their findings.

Phill Agnew, Director of Product Marketing at Brandwatch also highlighted the importance of customer and market research, stating:

"25% of the company’s marketing budget is wasted, it gets no ROI. There's another brilliant stat from HVR, they analyzed new product launches, and they found that on average 80% of new consumer product launches fail. If 25% of our budget is being wasted and 80% of new product launches fail, then clearly something is broken, something's not right."

We discussed consumer psychology with him in further detail, as well as how product marketers can apply the essentials within their practice.

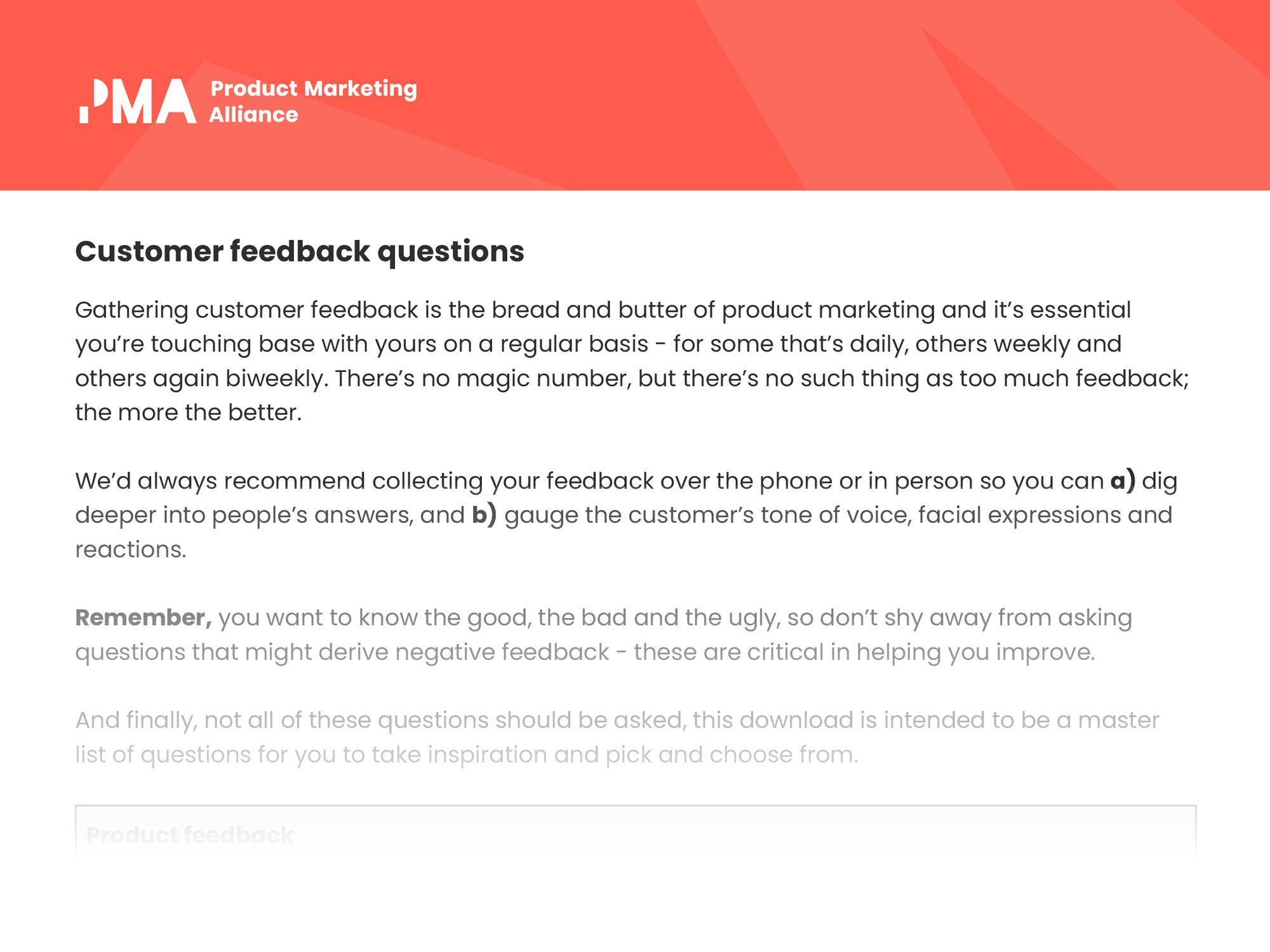

Examples of research questions

In some instances, some product marketers understand the importance of getting feedback from their customers but don’t have access to the relevant tools to do so.

If you’re not accustomed with customer and market research, don’t worry, we’ve got plenty to get you going. Our customer feedback questions master list can serve as your much-needed source of inspiration and help you as you search for the answers you so desperately crave.

We’ve also got a win-loss interview question master list for you to pick and choose from:

And tons of product marketing presentations from every PMM Summit to-date. For a taster of what’s to come in our all access, OnDemand video section, check out PMMfixx:

Recommended research tools

There’s very little margin for error for product marketers when it comes to market research. Thankfully, there's a whole bunch of customer and market research tools you can use to make the process seamless and reduce the likelihood of any mistakes.

Access this complete toolkit - and more - right here. 👇

Want to learn more?

Market research is an invaluable part of not just product marketing, but the overall organizational function. It helps us to understand what prompts the customer to purchase products within the market and, ultimately, identify how we can position our products in such a way that they stand out from the crowd.

Our Market Research Certified: Masters course has been designed to help you streamline your approach for success. By the end of this course you’ll:

🧠 Understand the importance and benefits of research for making the most impactful and strategic decisions.

🧐 Know about the different types of data and where best to source it.

🔬 Be aware of the best research methods available for conducting valuable data for your company.

✌️ Be able to consider the ethical implications of market research and data collection.

Get Market Research CertifiedProduct marketing is and always will be a customer-centric role. A core part of your job is to value the voice of the customer and advocate for their wants, needs, and pain points. It’s your responsibility to make them feel heard. Therefore, customer marketing is an integral part of what you need to do to ensure that you’re staying true to this.

The Customer Marketing Certified: Core course has been designed to give you invaluable, practical insights into streamlining your customer marketing approach so that you can ensure that:

- Your customers are happy,

- Your products are the best they truly can be,

- Your brand reputation is consistently positive, and

- That you bring in increased revenue for your organization.