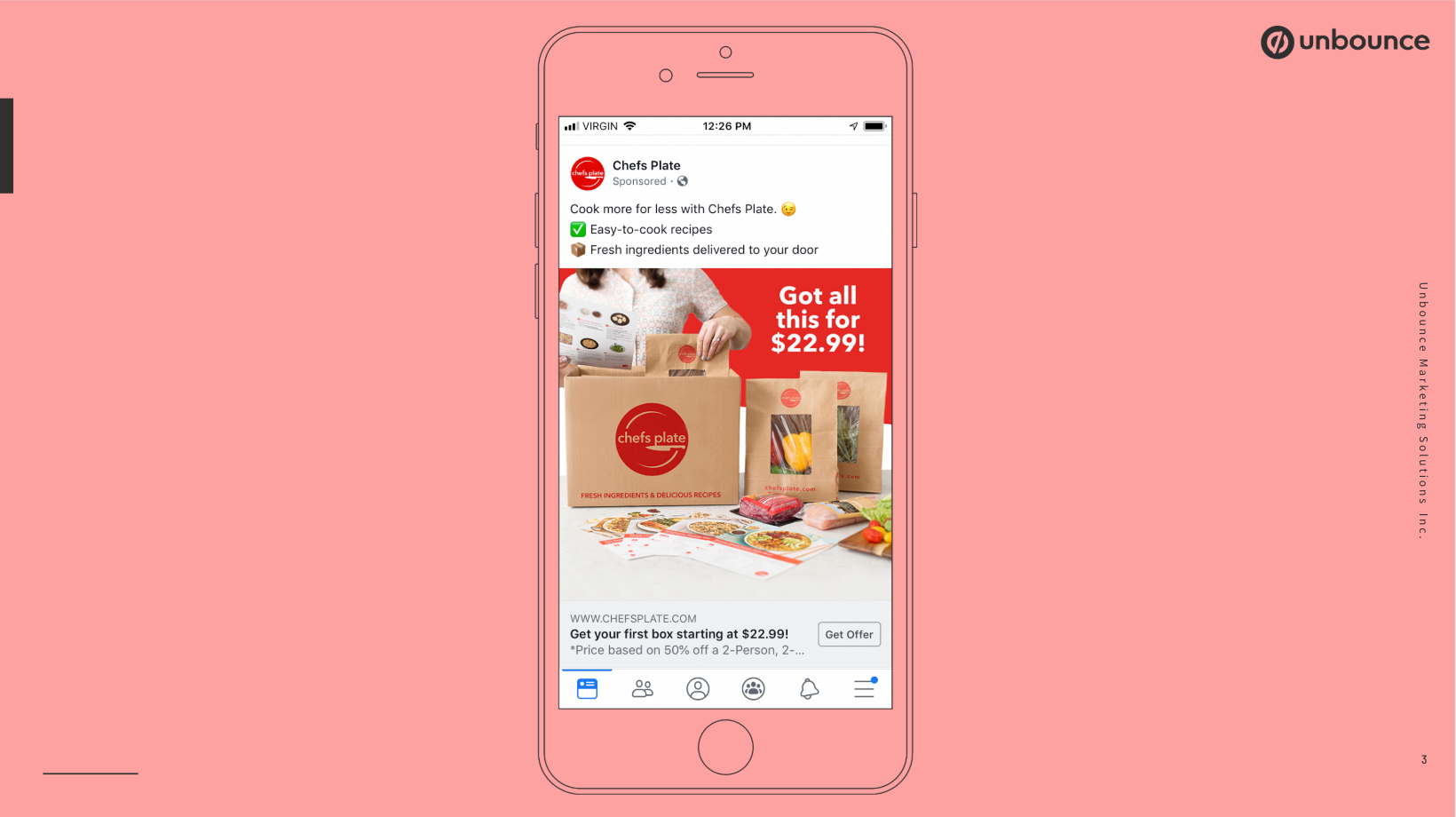

Irrelevant marketing is aggravating, am I right? How many times in the last week have you seen an ad that just was not meant for you? Maybe it was for a different location, or for a product you would just never buy. Here's an ad I we saw on my Instagram feed a couple weeks ago. It's not terrible. It's not the prettiest ad I've ever seen, but there's nothing terribly wrong with it. In fact, I actually hate cooking, and I'm always looking for easy solutions.

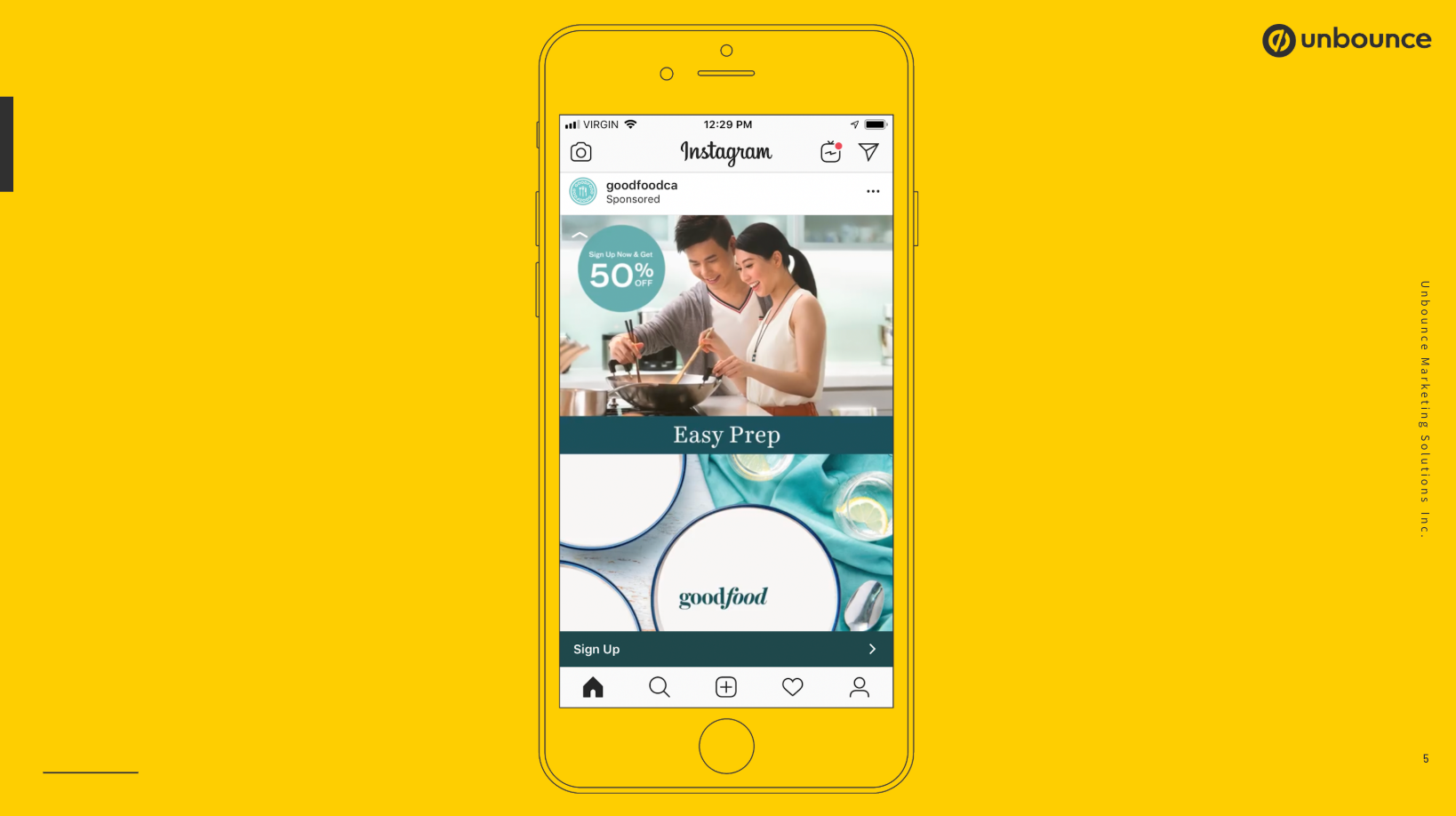

But then I saw this one and it's the exact same message from a different company.

Finally, I saw one more...

Again, I've already told you that I hate cooking and the chances are I've probably even done a Google search for meal kit. So why was I so frustrated? Because I'm actually a customer of all three companies. And I don't know if you noticed, but they are all trying to get me to sign up for a new offer, and as a customer, these companies should have known I was a customer and they should have excluded me from these type of initial ads.

Irrelevant marketing isn't just online

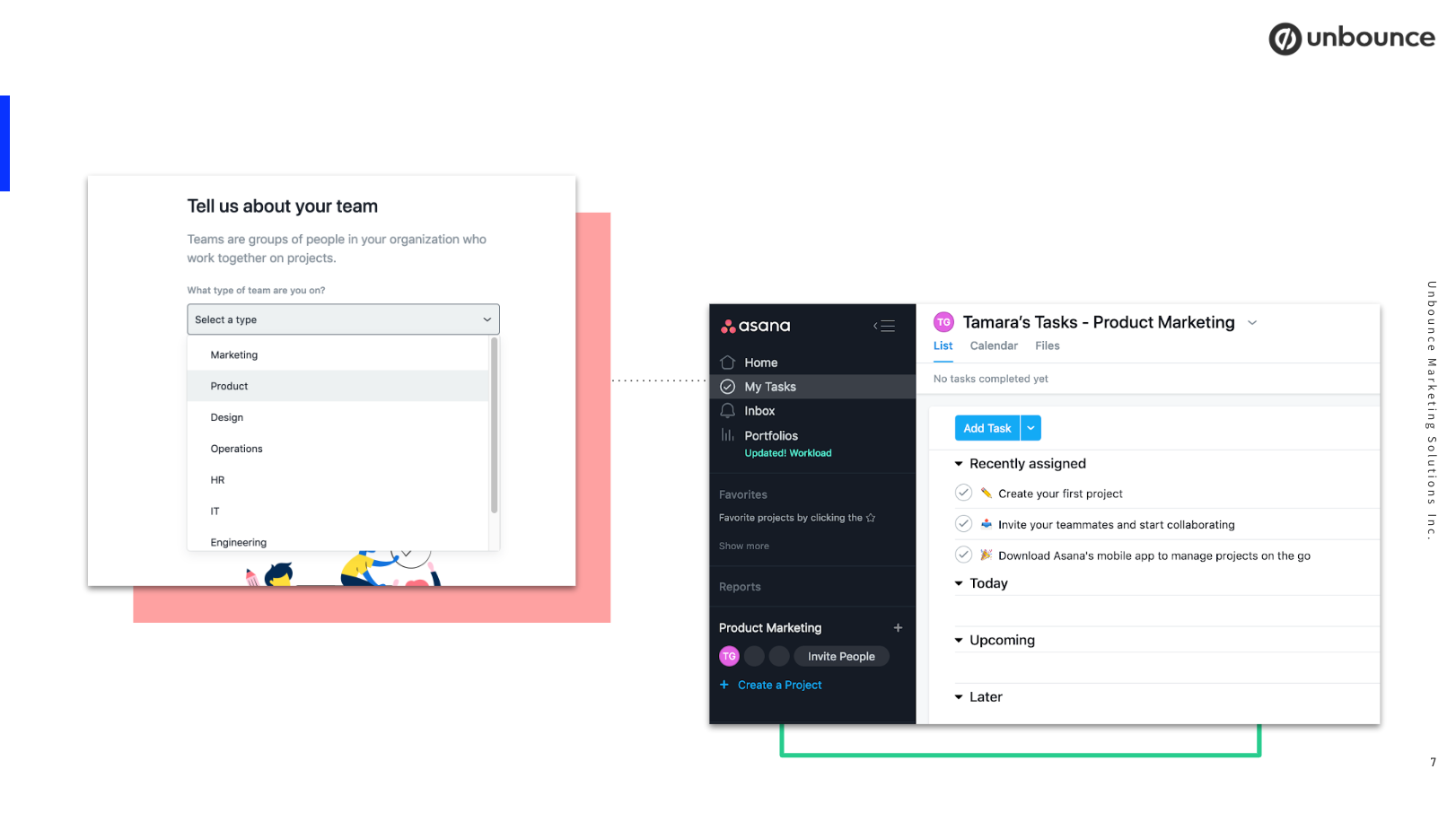

Instead, they've wasted their precious ad dollars and they've risked annoying an already happy customer. Irrelevant marketing doesn't just happen online, it also happens in-app too. Here's an example of a free trial that I signed up for a couple weeks ago:

I wanted to see what personalization looked like in onboarding. So, they asked me to answer a couple of questions about my team. I said I worked for a marketing team and then I jumped into the product. What I saw was that they didn't listen to anything I said, the product's not bad by any means, but they dropped me into the same generic experience that I would have seen if I had said I was on the product team or the engineering team. So why did I bother answering the survey?

I'm not the only one that feels frustrated by this. 71% of consumers say they are frustrated when they have an experience that is not personalised. Relevancy is now table stakes and actually, 80% of customers say the experience you provide is just as important as your products and services. So you may have the best product on the market, but if your competitor is offering a better experience, they're still going to win. And finally, 84% of consumers say that being treated like a person, and not a number, is important to winning their business.

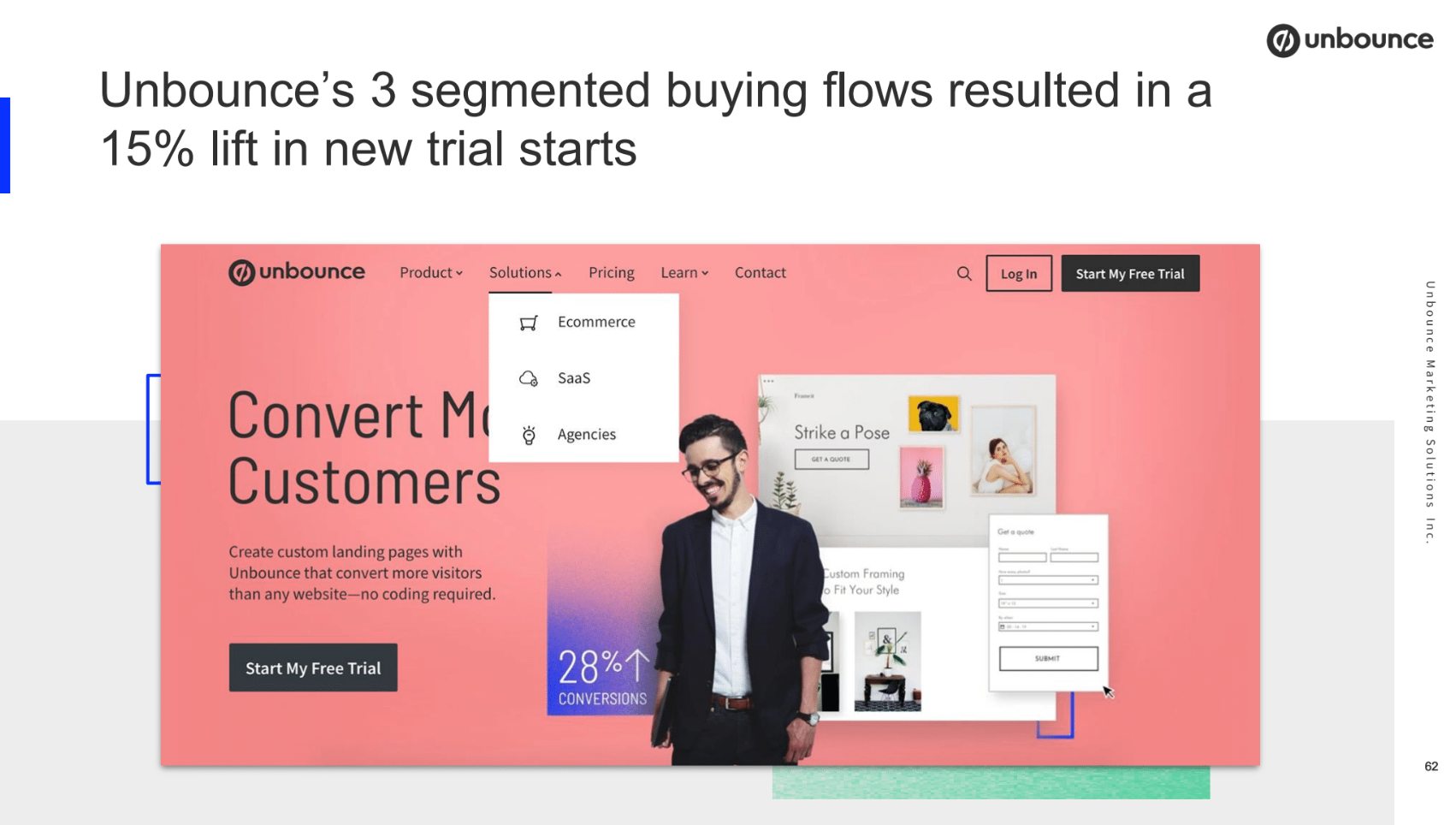

Relevancy isn't just great for your customers, it's great for your bottom line as well and we see this across the entire customer funnel. From an acquisition perspective, we saw that PPC here had a 24% lift when they implemented segmented Google ads. At Unbounce, when we went from one generic buying flow to three segmented flows, we saw a 15% increase in the number of new trial starts that came through the door.

MailChimp has done a whole study that proved segmented email campaigns not only improved open rates, but also click-throughs. So, I want you to take a step back and I want you to just imagine a world where every business delivered these relevant experiences, and where your product marketing team was able to focus on delivering the best experiences to your very best customers. It might look a little bit like this.

So remember I signed up for a bunch of free trials, the second company, which was in the same line of business as the first one, asked me even more questions about myself. I was pretty hesitant by this point, I answered the exact same questions and I said, "Hey, I work in a marketing team, this is the size of my team". But this time, when I got in-app, I saw this screen. They said, "Hey, we know that you're a marketing team and here's three different templates that you can use to get started today". Immediately, I felt completely different than I did the first time. I felt like "Hey, I'm in the right place, this product was built for me". And what's more, a couple days later they started advertising to me in-app and they said "Hey, we know you're using this product Monday for marketing and we're actually going to direct you to a couple of pieces of documentation that will teach you more about how to use this product".

Why aren't more marketers using personalization?

So if we know that customers prefer personalization and we know it's good for your business, why aren't more businesses doing this? The truth is 55% of marketers do not feel like they have the insights that they need to deliver this level of personalization. This lack of insights is creating confusion across teams, and so imagine this scenario...you have a marketing team and they've just published a new lead-gen piece focused on small to mid sized businesses. But, at the same time, your partnerships team has just signed a new partner in the automotive space. Then you have a product team and they're building a really, really great feature for realtors. And finally, your sales team has just signed this huge enterprise deal with 50 users. Each of these teams think they're doing an amazing job, but they're all working in a silo. And actually, it's just one giant mess.

So let's plot these teams a different way, on a wheel this time. Let's start with marketing. Marketing's job is to attract prospects and turn them into trialers, then, depending on the average deal size, sales will step in to help convert them and get them onboarded. Once they're a paying customer, Customer Success is going to make sure that they see the value throughout the entire customer lifecycle. While, at the same time, partnerships are trying to expand the ecosystem to continuously bring in new value. And, the product management team is building new features to solve these customer problems. But again, like that last example, imagine that each of these teams are focused on a completely different customer segment. This wheel is never going to spin any faster and you're never going to get momentum as a business.

But, when Product Marketing lives in the middle of this wheel, we are able to align all of these different teams, and we're able to build one cohesive customer strategy that will create momentum. In fact, I actually believe that product marketing is the linchpin to sustainable business growth and in this article I'm going to walk you through why that is.

You may be thinking, how am I possibly going to align all of these teams? I have a very busy day today. But I'm here to tell you that the role of product marketing is evolving. In the old world of product marketing, we were handed a product when it was almost ready to be shipped, we had to build some value props, maybe some sales enablement materials, and host a webinar too. But the new world of product marketing is led by strategy. In this world, we are responsible for understanding what's happening in the market, and then leveraging that data to build revenue and growth strategies. We get to influence the product roadmap and we are responsible for ensuring that customers see the value of our product.

Enter customer segmentation

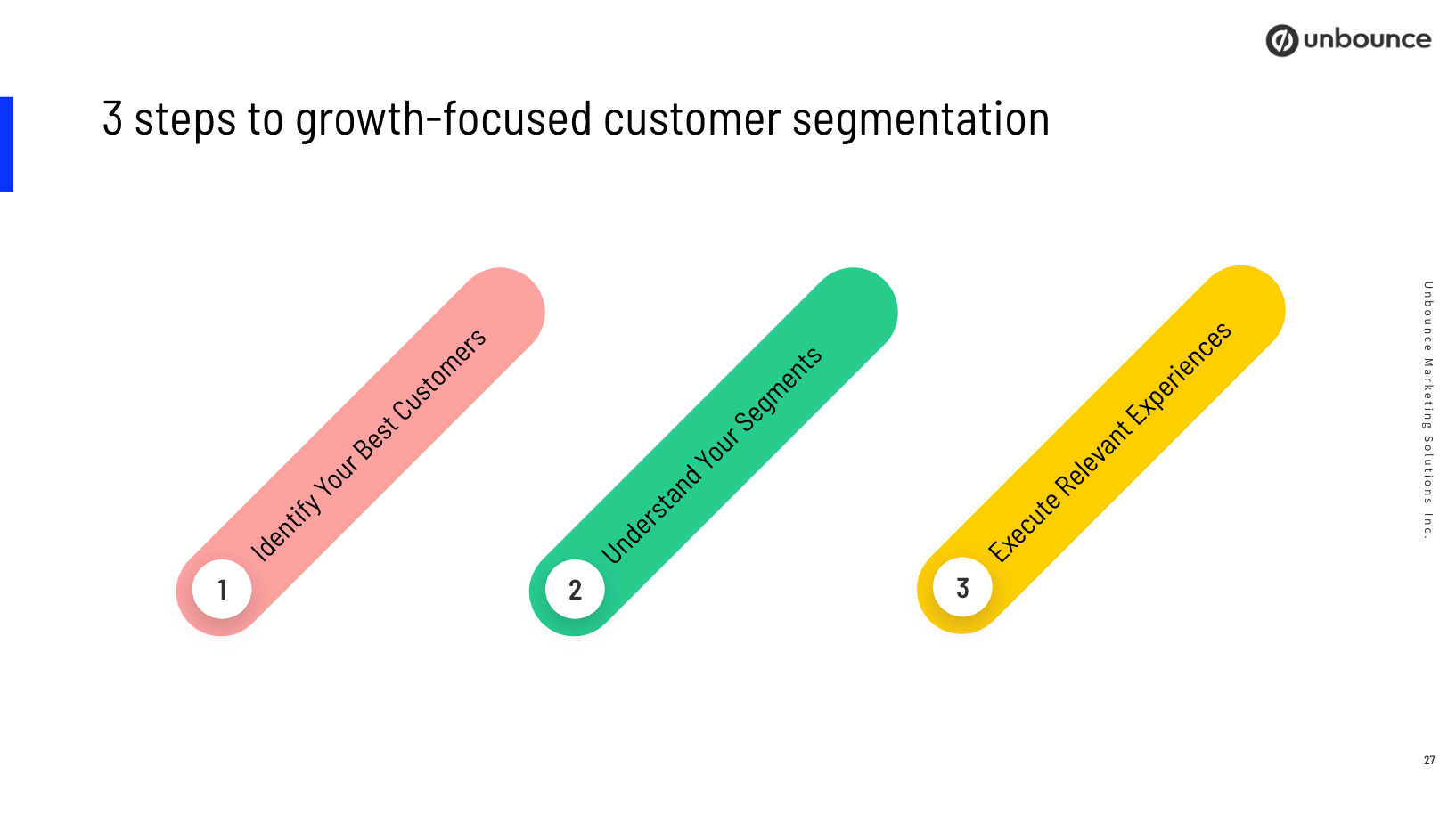

But, how can customers see the value of our product if we don't understand who first finds us valuable? And so that's where customer segmentation steps in. At unbounce, our product marketing team's mission is to deeply understand both our customers and our market in order to showcase our product's value and identify strategic opportunities for growth. So next, I'm going to walk you through three simple steps for you to implement a growth-focused customer segmentation strategy in your own business. I'm going to start by identifying your best customers, then we're going to learn more about those target segments, and finally, we're going to let you execute relevant experiences that will convert and delight. So, let's get started.

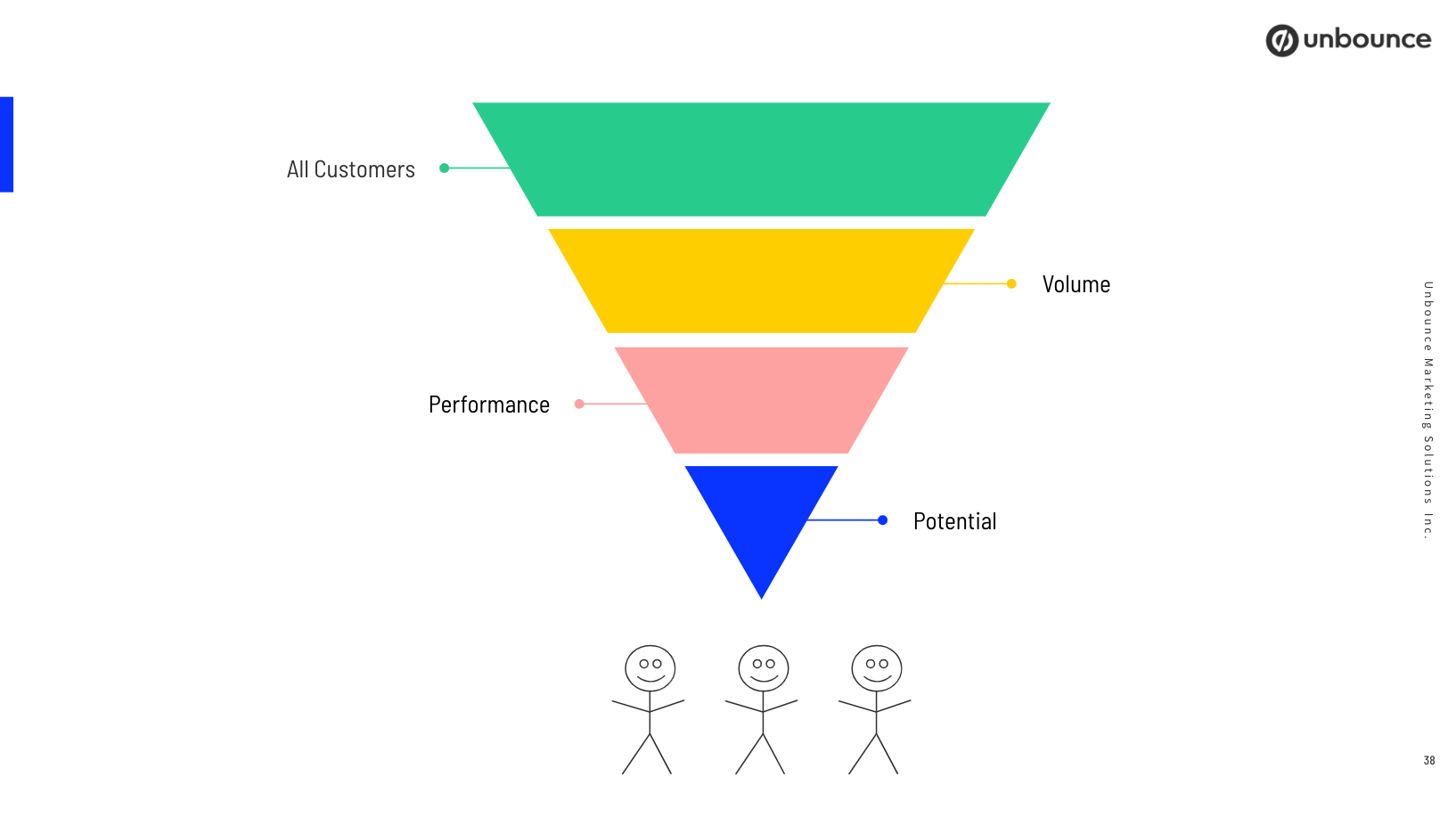

When you're starting to talk about 'best', this could become very subjective but I'm going to give you three criteria to make this more objective. The first one is volume. When you look at all of your customers and your customer base, how can we start to group them together based on attributes that they have in common? Then, how do we layer that with performance data to understand what groups of customers perform better than other groups? And then finally, what is your company's potential to be able to acquire more of these customers and win in that market? Let's dig a little bit into volume.

When you start sorting by volume there are all kinds of different things that you could slice and dice by and this is going to depend completely on the type of business you have - so maybe things like industry or business size is super important for you, or maybe it's more important to know the use case the customer has, or their job title, whatever it is, take as many data points that are available to you and really start slicing, dicing and identify the patterns that emerge. Then you'll start to see that there are groups and clusters of customers that have things in common.

I want to give you a word of warning though, don't just turn up the volume, and what I mean by this is that your largest group of customers is not always your best customers. So you might look at this analysis and say "Hey, 40% of my customer base are dentists, dentists must be the best customers". But that's not always true because they may not be performing very well, you might just attract them. So what we need to do is layer this volume data on top of performance data. When we're analysing by performance, I have a few different things that I would suggest you look at...

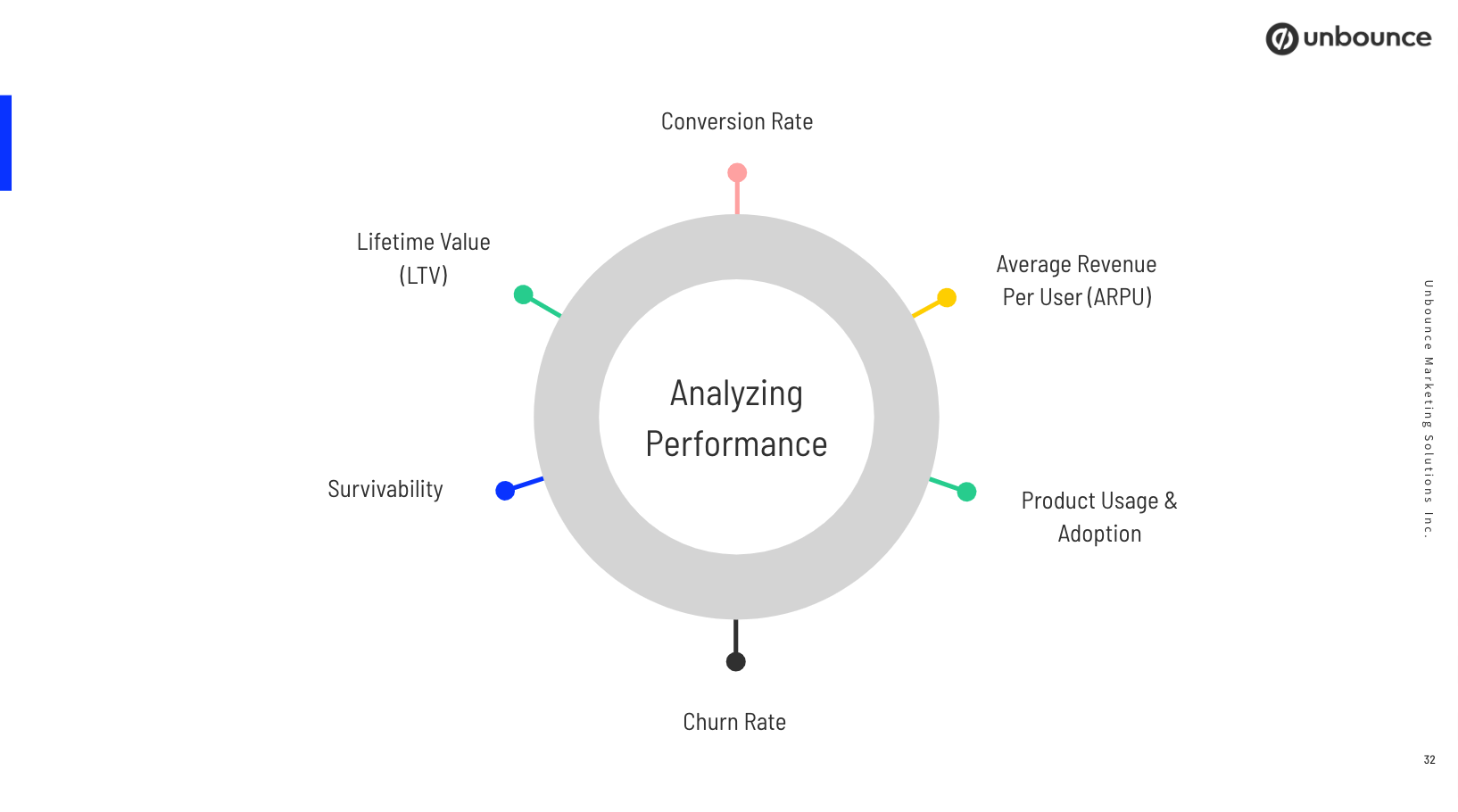

Conversion rate

The first one is conversion rate. So this could be the acquisition to trial conversion rate or it could be the trialer to paid customer conversion rate. Either way, which customers are more likely to convert into your product than others? That's a really good first signal.

Average revenue per customer

The second one is average revenue per user. Do you have groups of customers that are more likely to choose a higher price plan? If that's something that's important to your business, it's really good to look at this.

Product usage

It's not enough for a customer to just buy your product, what you actually want is for them to use your product as well, and so looking at how these customer segments are using the product is really important.

Churn rate

The fourth is churn rate. At what rate is this customer segment churning out? How long did they last? And do we feel like this is something that we can either decrease or maintain? Hand-in-hand with churn is survivability. What's the average tenure for this particular customer segment? Do they stay longer in your customer base than the average? That's really important in the long run.

Lifetime value

And finally is lifetime value. What is the value these particular customer segments will bring to your business? Because as you start to get more of them, they're really going to contribute to the success of your business.

Of course there are tonnes of different software you could get that would help you do some of this analysis but in my experience, that software is either prohibitively expensive or takes months to connect to all of your different resources and data sources - if you can even get it to connect to your data sources. So if you want to empower your product marketing team to own customer segmentation, then I recommend you do it the scrappy way, which is through a Google Sheet. Once you've looked at volume you've identified the big clusters of customers, and then you've layered that over to performance, you should have a pretty good understanding of who you should be focusing on. It's then time to assess your potential to win in that area.

Customer acquisition cost

With this, I'd like to start with customer acquisition cost. How much did it cost you to acquire this particular type of customer? What channels are they coming in on? Are these two things scalable? Because as you grow your customer base, you're going to need to be able to acquire more of these particular types of segments which leads us into addressable market. So, looking at each of the segments that you have in mind, how large is the addressable market? And is that market large enough to match your growth ambitions? Because you're going to be focused on these customer segments for at least a couple of years. Third is the competitive landscape. So who else is going after these customers? Is it the same competitors you're playing with today? Or, by going after a new segment, does this introduce a new competitor? Answering yesterday's questions isn't bad, it just means you're going to have to go after a differentiation strategy versus a more blue ocean strategy.

Finally, it's the product. If you have a high volume of these customers today and they're performing well, chances are there's a great fit with your existing product. But that does not mean they are being represented on your future product roadmap, and so you really need to bring your product manager along on this journey with you, because by this point, they need to start prioritising these customer segments just as much as you do - I'll talk a little bit about that shortly.

So, we started with your entire customer base, we layered on the volume data and we identified some clusters that you saw a lot of things in common, we identified some patterns. We then layered on performance to identify which clusters performed the best and then we confirmed you believe you can win in this market. We're left with these little stick figures.

They're not pretty, they're just a couple pieces of data. We know that we need a lot more than that to be able to build a cohesive Go-to-Market strategy, and so what we actually need to do is we need to do a makeover to turn this stick figure into a full fledged customer. To do that, we're going to call in the help of the Fab Five. They're going to help us dig a little bit deeper and do this entire makeover, which is step two.

Quantified buyer personas

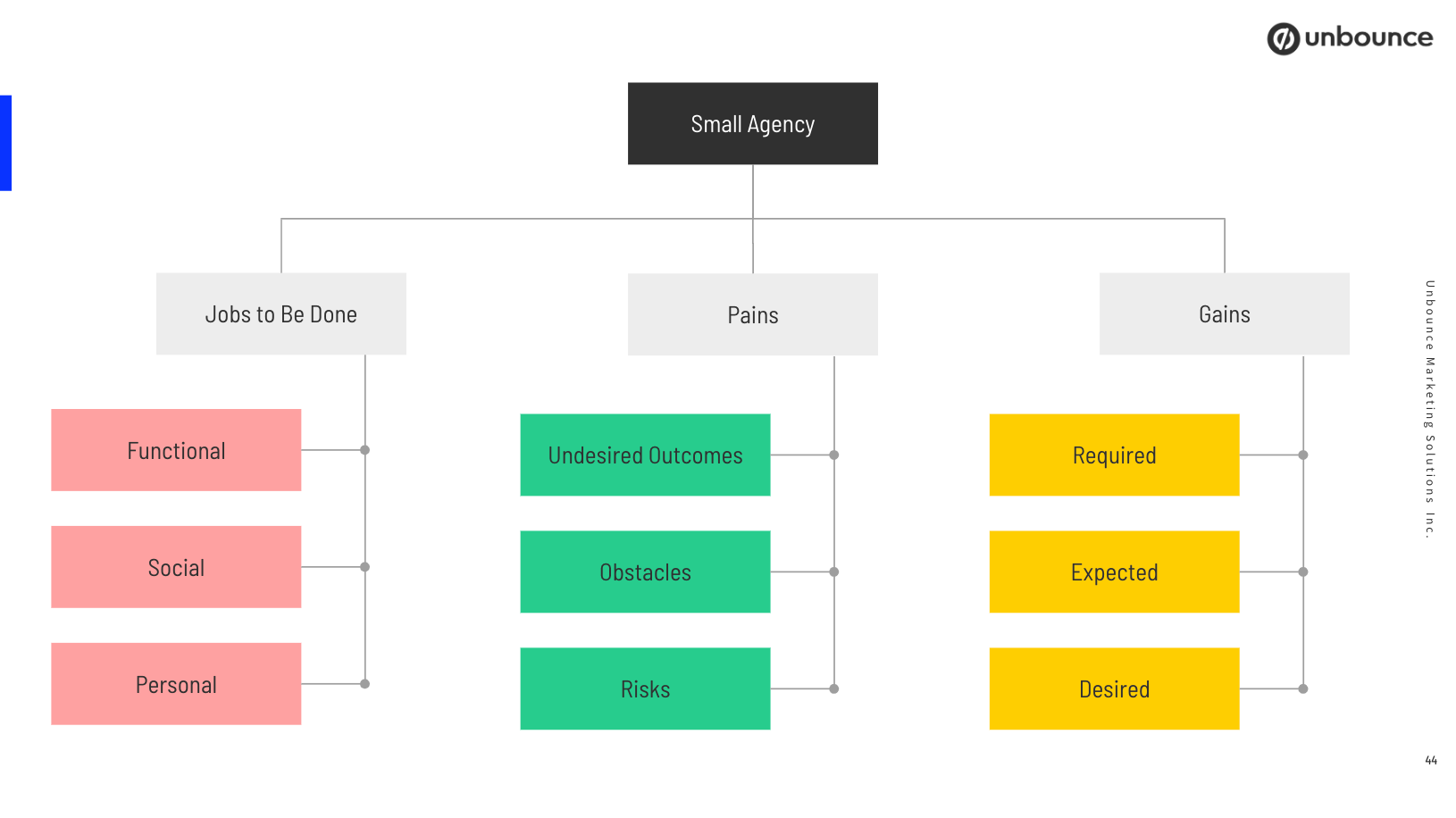

As we think about our makeover, I want to think about it through this idea of a quantified buyer persona. You've probably all done buyer personas in your life, but quantified ones are slightly different. They don't focus on personal attributes, they focus on business metrics. So I filled in the top three rows based on the information from step one and now, as part of our product marketing makeover, we're going to fill out the bottom half and we're just going to use the small agency one of our segments as an example to go through the jobs-to-be-done, the pain and the game framework.

So jobs are the things that your customer is hiring your product to do and jobs can fall into three different categories. They can be functional, which is really more task related - so maybe my job is to publish a landing page or get a marketing campaign live. They could be social, which has more to do with influence - so if I publish this landing page, I'm going to impress my client and seem like an expert. Or they could be personal and this is more emotionally tied - so by building a landing page, I'm now able to gain a new marketing skill and I feel more confident in my skills as a marketer. All of these different jobs are going to be ranked differently, but write down all of the different jobs that the customer's hiring you to do and which ones are the most important to them by segment.

Then you can move onto pain. Pains can occur before, during or after completing a job and they have a bunch of different categories as well. Two good examples of pain could be the cost that someone has to pay to complete a job, or the time that it takes them to complete a job. So by choosing your business to complete the job for you, they can erase one of those pains. And then gains, gains are always positive outcomes that a customer wants to see once they've completed the job. So there's these 'required' gains and your business better meet these gains, otherwise, the customer's not going to stick around, but then there's other nice to have gains that could work as well.

If you're interested in this framework I recommend you check out Value Proposition Design, it has a tonne of probing questions that will help you do your customer interviews and get to the bottom of all of this.

Identifying features

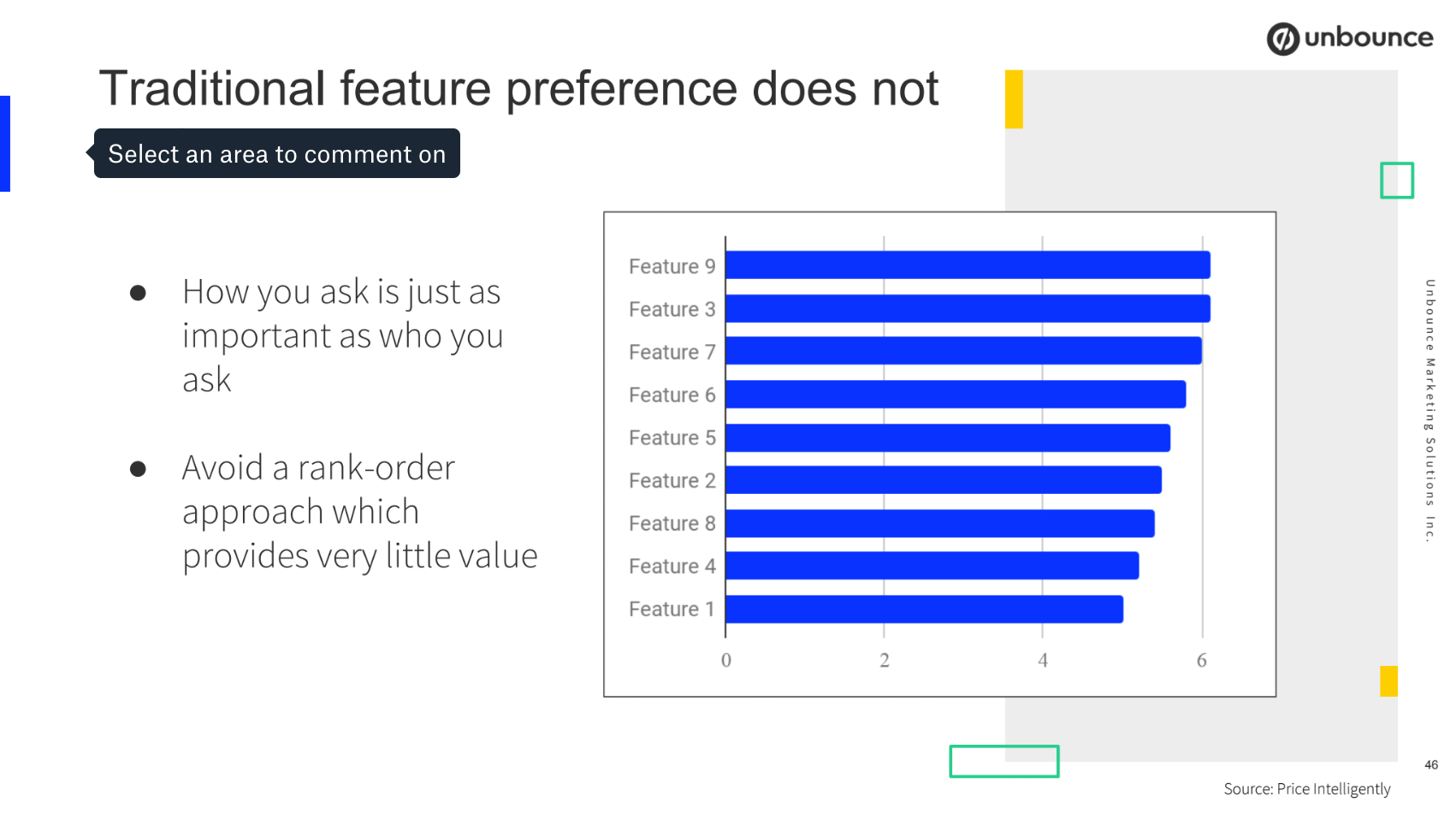

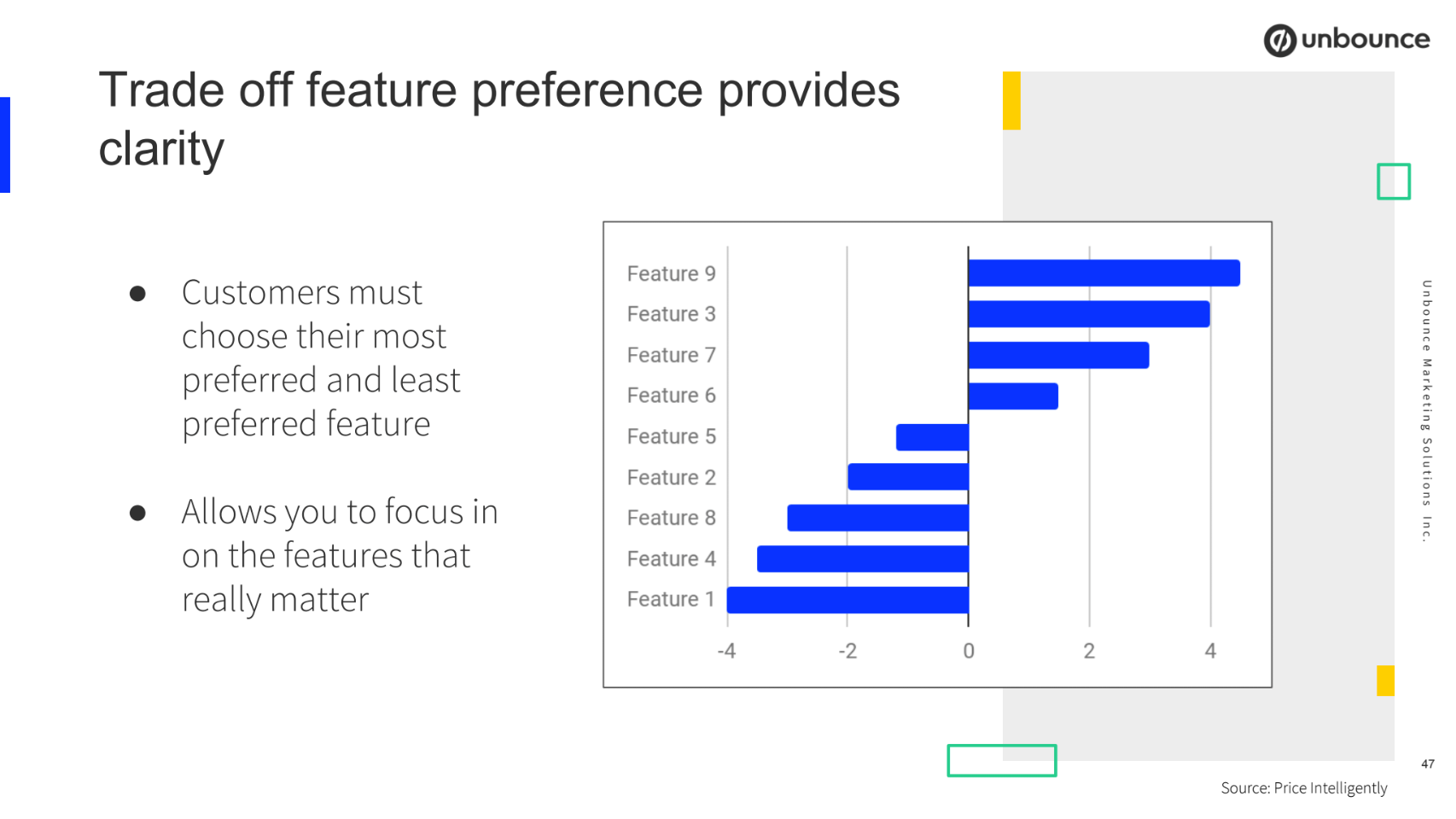

Now that you know the jobs to be done and what they're hiring your business to do, you can start to identify what features you have that will help them complete that job. Traditionally, what this would look like is you send out a survey to your customers with a list of maybe 10 features and you ask them to stack rank it, but what you'd get back is a chart that looks something like this:

I don't know about you, but I couldn't make any business decisions based on this. I can't tell the difference between feature nine and feature one, it's very small. So when you actually do a trade off feature preference you get a lot more clarity, and in this method what you do is you ask the customer to choose the number one preferred feature, and then the feature that they prefer the least. When you get all the responses back, you plot it onto a chart that looks more like this:

All of a sudden, it becomes super clear the top features for each segment. I know this segment prefers the top four features here, they couldn't live without them. But I also know they don't want the features at the bottom, so either I don't talk about those or I don't include them in my package at all. And so then once I know what features they want and don't want, how do I decide how much that segment wants to price for them? Because each segment wants to pay a different price, I promise you that. Again, you could send out a survey and you can ask your customers, "hey, here's a package, what do you want to pay for it?", but they're going to give you a really lowball answer because they want a deal. Instead, I recommend you do a Van Westendorp price sensitivity survey. This is essentially composed of four different questions and by getting the answers to these four questions, you will get a much more thorough idea of the price they want to pay. These are:

- At what price would my product be so expensive that you would not consider buying it?

- What price would it be just getting expensive, but you would still consider to buy?

- At what price would it be a bargain and such a great buy for the money?

- At what price would it be so cheap that you would actually be worried about the quality of my product?

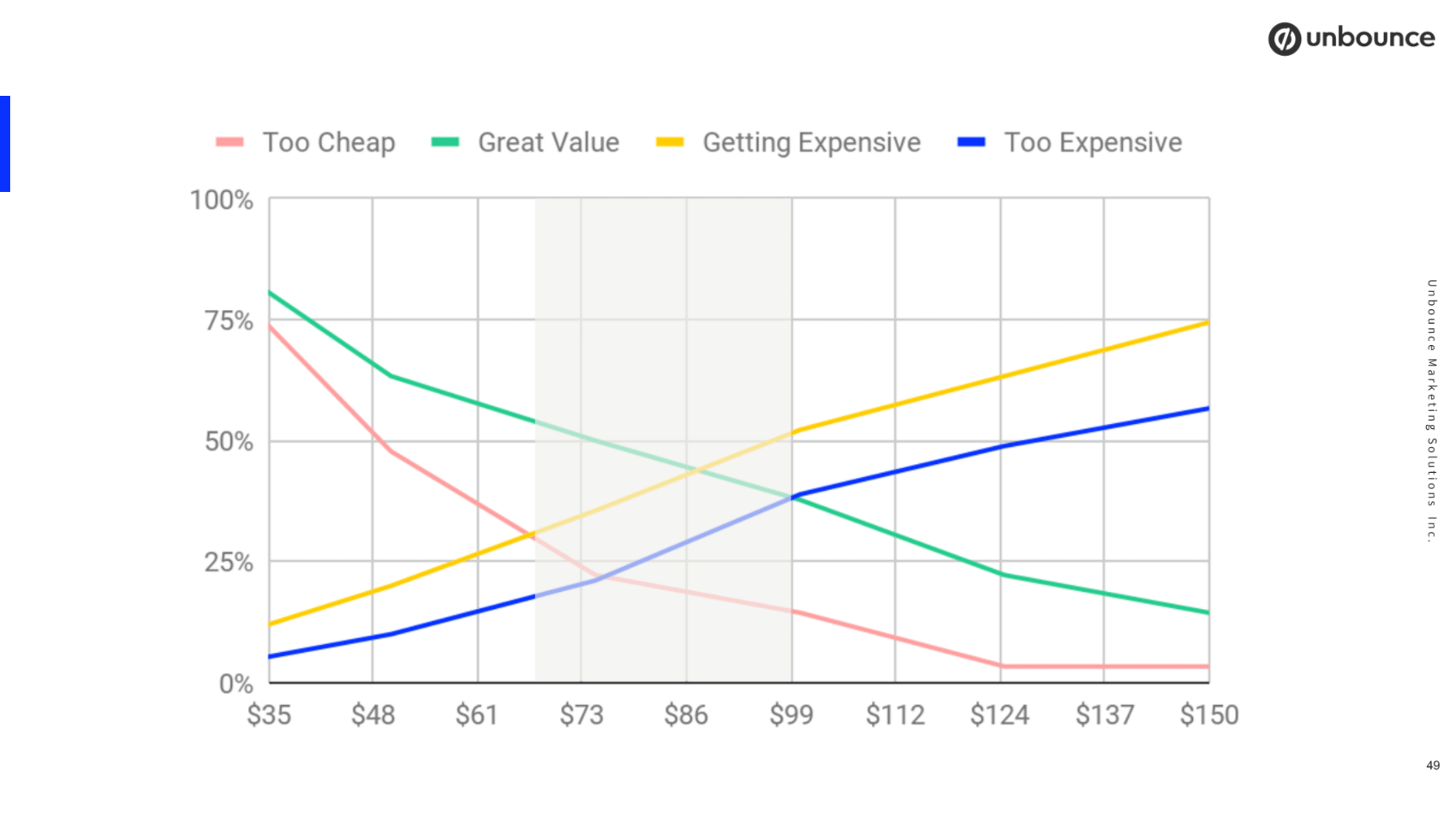

When you get the answers back you're going to build a chart that looks like this:

You can see that this grey bar is really where the four different lines connect and somewhere within this grey bar is where you want to price your product for this segment. This is where you're going to have the best opportunity of conversion rate with a sustained Average Revenue Per User.

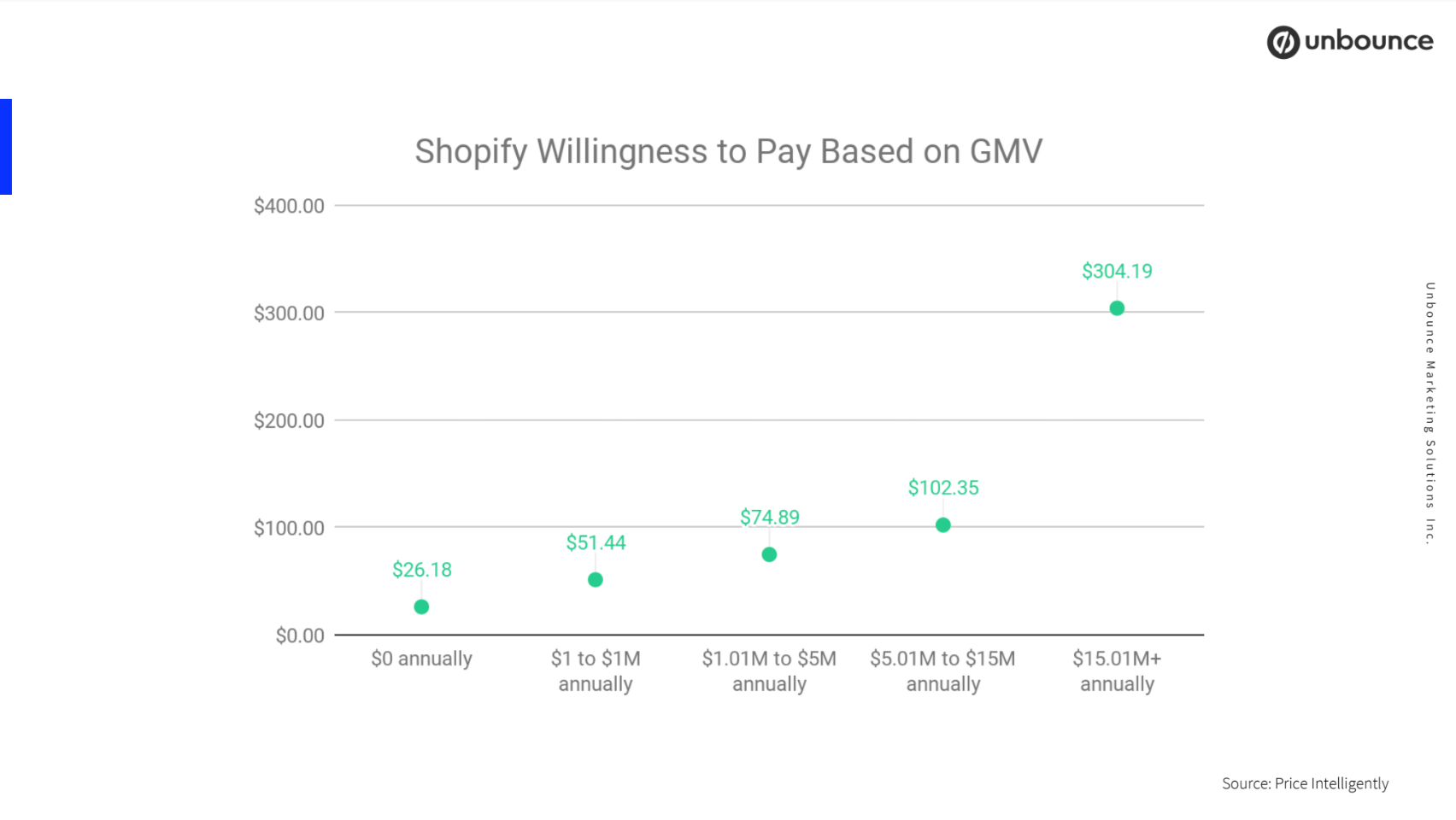

Here's another example of how Shopify did this method for each different segment.

So the on the bottom is their five different segments and then going up is each willingness to pay. If you were to look at the first four segments, you would notice that the price they're willing to pay goes up incrementally. So if I was going to use some common sense, I might say, well, how much might the last segment want to pay? I made $150. But, by doing the Van Westendorp, we actually discovered they want to pay $304. If I had gone with my own common sense, I would have left $150 per customer on the table, and so this really is the better way of going about doing willingness to pay.

Now that we've kind of gone in, done our makeover, we've gotten some more information about our customers, we're able to complete our quantified buyer personas, we've done all of the exercises that we just talked about per segment, we have a really clear view of what each segment wants from us and how we can go to market for them. As a result, we're able to take that stick figure and use some Fab Five magic and turn it into a full fledged human being:

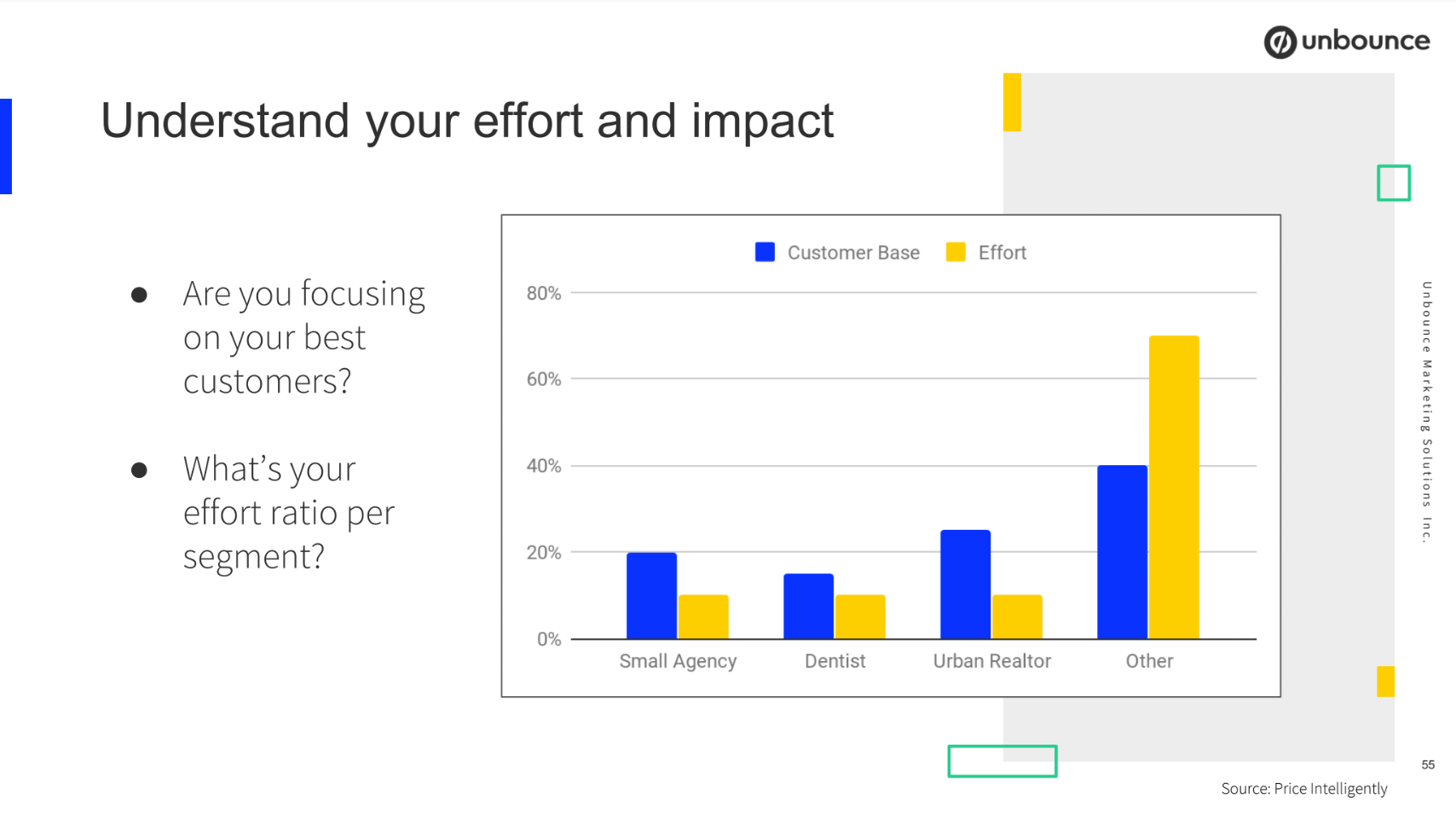

Now we're able to go to market and actually execute these relevant experiences that will convert and delight them. But, before you start marketing and before you start building your plan, you need to understand where you're currently spending your time. So, if these are new customer segments, the answer might be "well I'm not working on them at all", but, if you have one of the segments that are still the same you might want to do this activity.

So you can see in the example above, this company is spending the majority of their time on this other bucket which is essentially all of the segments that they don't want to focus on, and so they need to start shifting that attention towards their priority segments. Setting some targets are going to help you do that. What do you want to achieve with your customer segments? Do you want more of them in your customer base? Do you want to change a particular performance metric that we talked about earlier? Either way, plot out what needs to happen to get there and then start realigning your resources.

Quantifying the impact

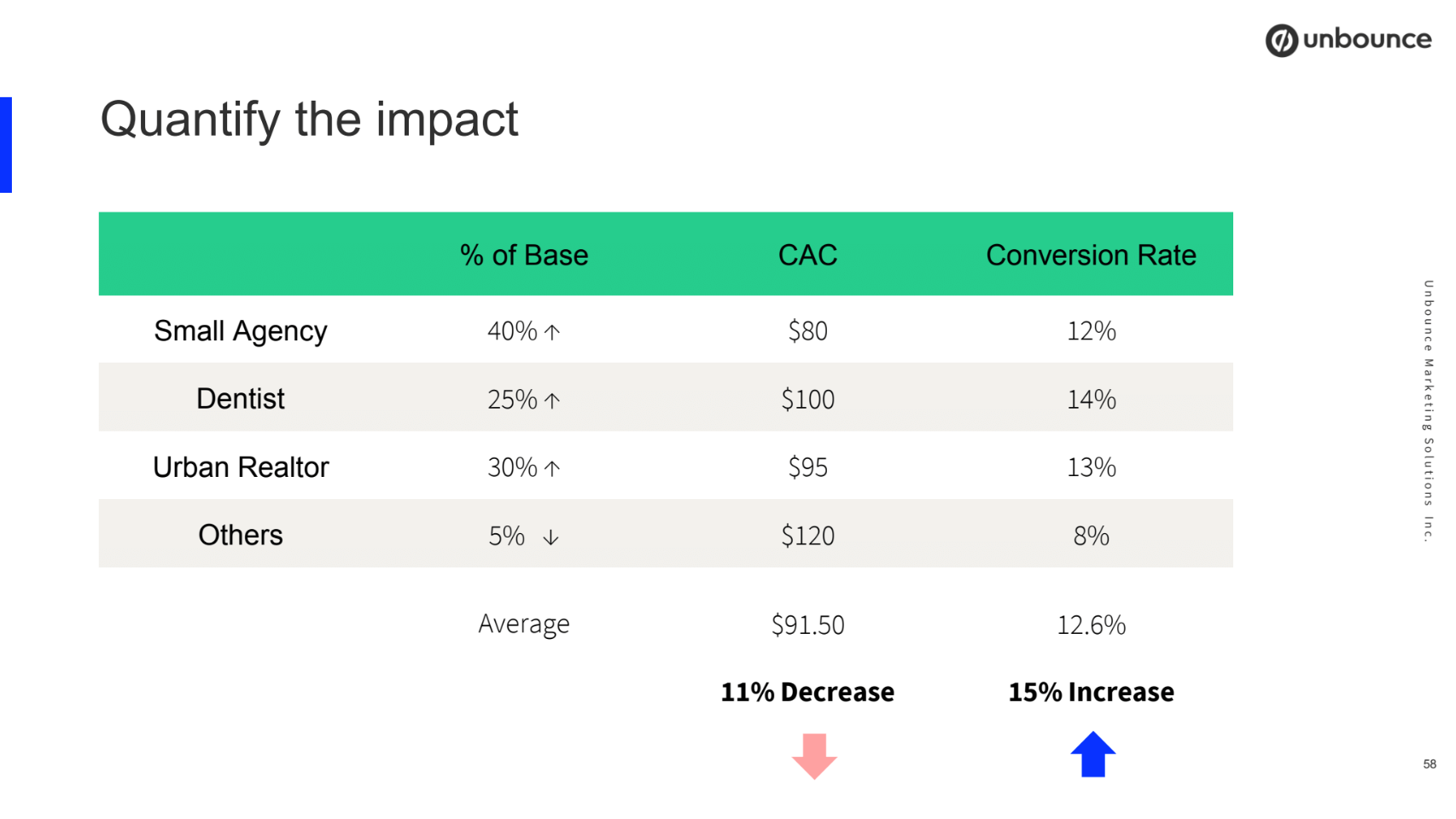

Here's what the tricky comes in, you probably do not own those resources. You can't just go to your engineer and say "Hey, please stop building that for the realtor" or you can't just say "Hey marketer, please build a different lead-gen piece", so you actually need to be able to quantify the impact of this change to bring your stakeholders along. Here's an example from that first example we looked at where the customers in the other category made up 40% of our customer base:

You can see here that their customer acquisition cost is way more than the others in the segment and their conversion rate is way lower, so they're actually bringing down our average. In this case, what we want to do is we actually want to decrease the amount of 'other' that we have in our customer base and we want to increase the amount of the different segments that we've identified. By doing that, by decreasing our 'other' to only 5% and increasing our top three segments to be the majority of our customer base, we're able to increase all of our business metrics, and so we're able to actually decrease our customer acquisition costs by 11% and increase our conversion rate by 15%. Imagine what this could do for your business if this is just one small change that you're able to make.

So now that you have an idea of the resources that are available to you and everyone's bought in, you really need to map what experiences currently exist for these customers. Again, if they're new segments, there might be no experiences, it might be all really generic, and then what's the sentiment of those experiences? Are they super negative? Are they neutral? Or are they great? Once you have this, you're able to say "This is where I need to start, this is what I need to improve right away". I'm going to walk you through a couple different examples of how you can apply segmentation across the funnel to improve these experiences.

Applying segmentation across the funnel

The first one is competitive campaigns. Competitive campaigns are an amazing way to stand out in the market when someone's searching for you or for your competitor, but if you do it in a generic way, it's not going to have impact. When I lead Product Marketing at FreshBooks what we saw was that QuickBooks was our biggest competitor and they had two products, they had QuickBooks self-employed and they had QuickBooks online. Each of those products actually mapped back to a completely different customer segment for us and so we could have just built one landing page that said "hey, this is the value of FreshBooks over QuickBooks, but we didn't. We built two landing pages. We built one that was for the smaller customer segment who would buy QuickBooks self-employed and then we bought built a second for the larger customer segment of a bigger business who would buy QuickBooks online. That way, we were able to showcase to them the value props that mattered because we knew what job they were hiring us to do, and we were able to showcase the features that mattered most to them because we'd already done feature preference. As a result, we were able to win more deals.

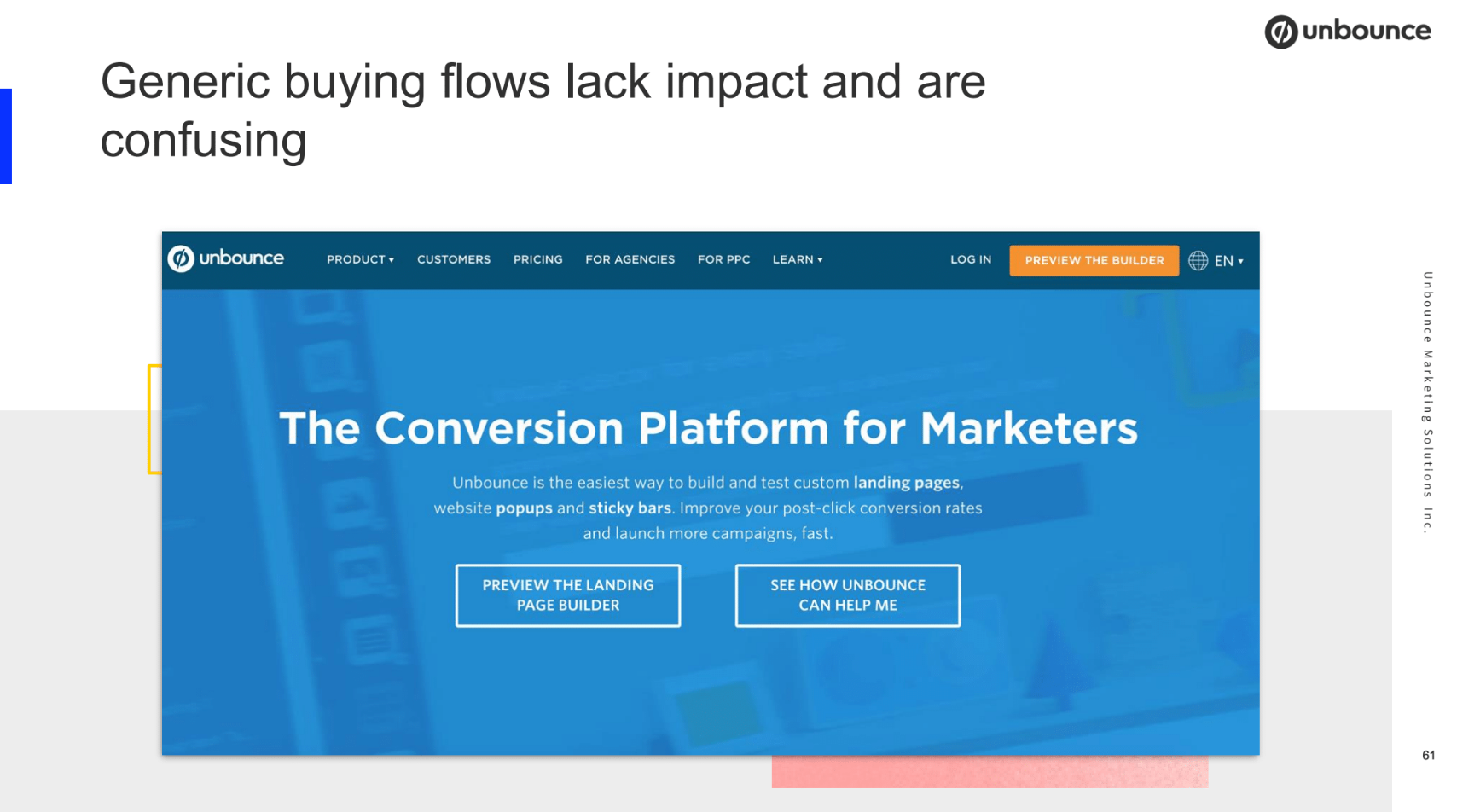

This is a look at the Unbounce website from a few months ago. It gets better, don't worry:

We had two problems. The first one was we only had one generic buying flow and when my team went through this exact same process that I walked you through today, we discovered that our new customer segments were not spoken to on this website at all. The second thing was that this website had been put together over the years, we're a 10-year old business, it was message after message after message, and it wasn't one clean message anymore, so we needed to overhaul it. This is what the new website look like now:

Not only is it prettier, but the major difference is now we have three segmented buying clothes and we've actually recently added another three. Now, when any of our core customer segments - of which we have three, - come to our website, they see a message that's meant for them. They know that they belong and that they're going to get something special. As I mentioned, we were able to increase our new trial starts by 15% because of this change.

Onboarding

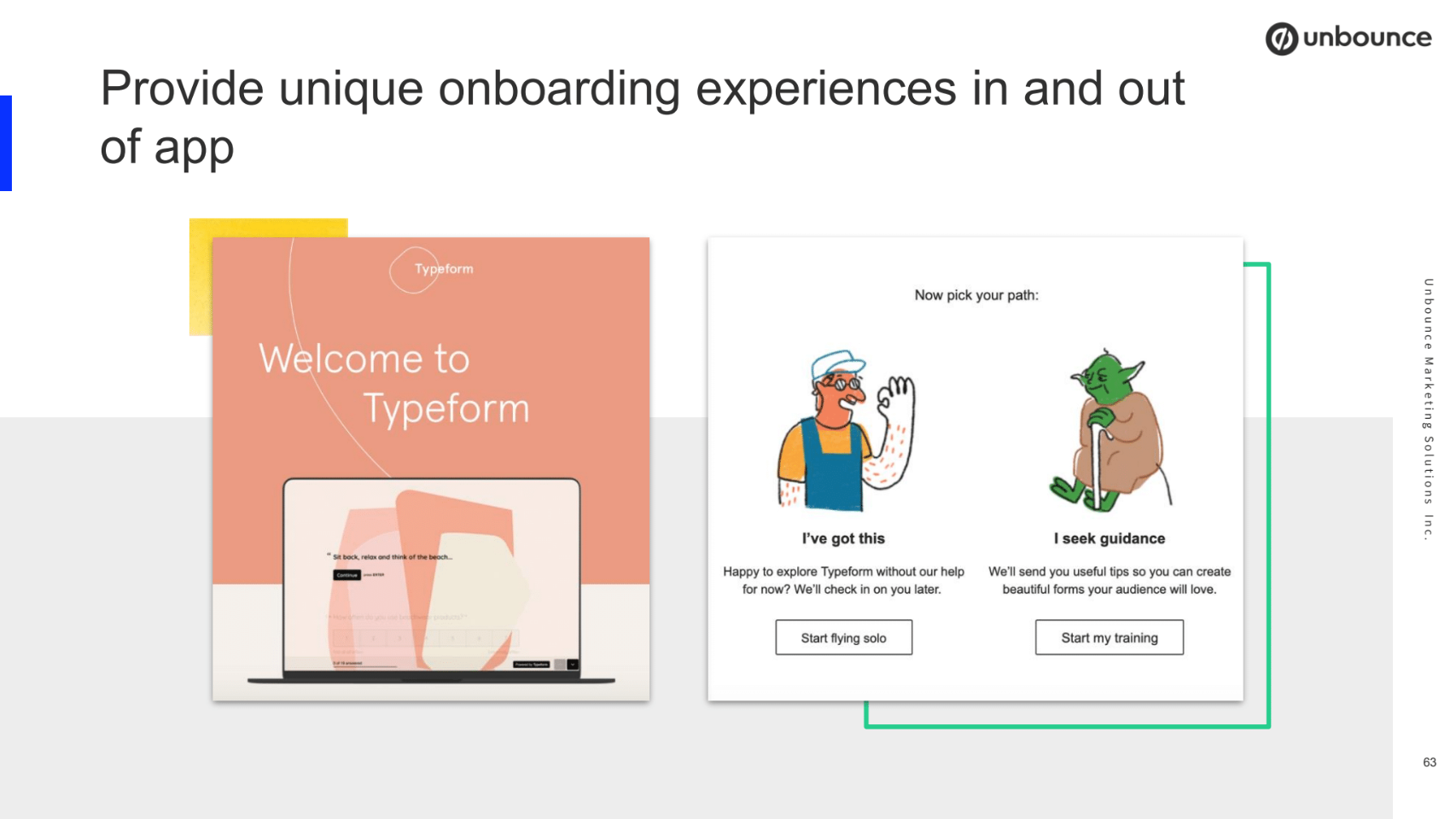

We talked a little bit about onboarding earlier, mostly in-app, but onboarding can happen out of app as well. Here's an example from Typeform who I think does a pretty good job:

So this is an email Typeform sends out when you sign up for the product and what you see is they actually asked you, the customer, to self-segment yourself. You can say "hey, I'm a new user, I need a lot of help with this" and then you're going to get a specific type of content. Or, you can say "hey, I've got this, I'm a pro, just let me be on my own". Either way, these two customer segments are going to get content that's meant for their sophistication level and it's going to feel super relevant to the experience they're having at that time. I said I'd come back to the product roadmap and so now's a great time, when we're thinking about adoption, to look at the product roadmap. So what's coming up in your roadmap that's reflected for your customer segments? Or are you building something that actually is not in service of those segments? You might have to have a really hard conversation with your product manager. And then moving forward, anytime that a feature gets added to your product roadmap, you need to identify what segment you're building it for. It could be all of your core segments, but it needs to be called out so that everyone's aligned from the very beginning what the opportunity is.

After you've applied customer segmentation across your entire funnel, you've been able to, hopefully, take all of those negative experiences or neutral generic experiences and turn them into highly relevant and positive experiences, this is going to result in an aligned customer strategy that will deliver that momentum I talked about earlier. This time, you have a marketing team who's focused on small agencies, you have a partnerships team that's focused on small agencies, and you have a product team that's building features for small agencies. You guessed it, you have a sales team that's focused on small agencies. I don't know about you, but that's something to celebrate because that is hard to make happen.